Our company formation consultants have efficiently helped clients set up a company in Cayman Islands for many years now. The Cayman Islands Exempted Company is the most widely-used business form by foreign investors looking to do business in the British overseas territory. This company can carry out its activities outside the Islands, however, it may hold investments here.

| Quick Facts | |

|---|---|

| Types of companies |

Exempted Company Ordinary Resident and Non-Resident Company Foreign Company Limited Liability Company (LLC) |

|

Minimum share capital for Exempted Company |

No minimum capital, however, registration & annual fees apply |

|

Minimum number of shareholders for Exempted Company |

1 |

| Time frame for the incorporation (approx.) |

4 working days |

| Corporate tax rate |

– |

| Dividend tax rate |

– |

| VAT rate |

– |

| Number of double taxation treaties (approx.) | – |

| Do you supply a registered address? | Yes |

| Local director required | No |

| Annual meeting required | No |

| Redomiciliation permitted | Yes |

| Electronic signature | Yes |

| Is accounting/annual return required? | Yes, a simple annual return for the Exempt Company |

| Foreign-ownership allowed | Yes |

| Any tax exemptions available? |

– no corporate income tax, – no capital gains tax, – no payroll tax or other direct taxes |

| Tax incentives |

There are no tax incentives as there are no taxes on corporate income. |

The Islands have been one of the traditional offshore jurisdictions alongside Bermuda and it is their longstanding tradition that continues to make them attractive to foreign investors worldwide who are interested in opening a company in Cayman Islands. The state provides a highly regulated, internationally acknowledged, tax-neutral offshore business climate which is dynamic and responsive, with more than 90,000 active companies being registered here.

The fact that they were once part of the British Empire means that the current legal system is based on the English Common Law – another advantage for foreign investors interested in opening a company in Cayman Islands.

The characteristics of the Cayman Islands exempted company

In order to set up a company in Cayman Islands, you can choose the Exempted Company or the Non-Resident Exempted Company. The first business form tends to have a higher degree of popularity among foreign entrepreneurs because of its tax-exempt status.

The Cayman Islands exempted company offers a multitude of benefits, and this type of company is one of the primary reasons why the jurisdiction is chosen by many offshore investors. Below we present you a list of the most important advantages of the exempted company:

- Full foreign ownership: this company can be 100% foreign owned and it can be incorporated with just one director, with no residency requirements.

- Limited liability: the founders are liable up to the amount they invest in the company. We can offer more details about how to open a company in Cayman Islands.

- No capital: there are no requirements for the mandatory subscription of a share capital upon incorporation.

- Minimal accounting: for this type of company, the annual reporting requirements are reduced to a minimum.

- No public information: the details about the company shareholders are not disclosed publicly, like in other countries.

The Cayman Islands exempted company derives its name from a twenty-year guarantee that will not be subject to taxes (although there are no taxes for companies in the Cayman Islands at present).

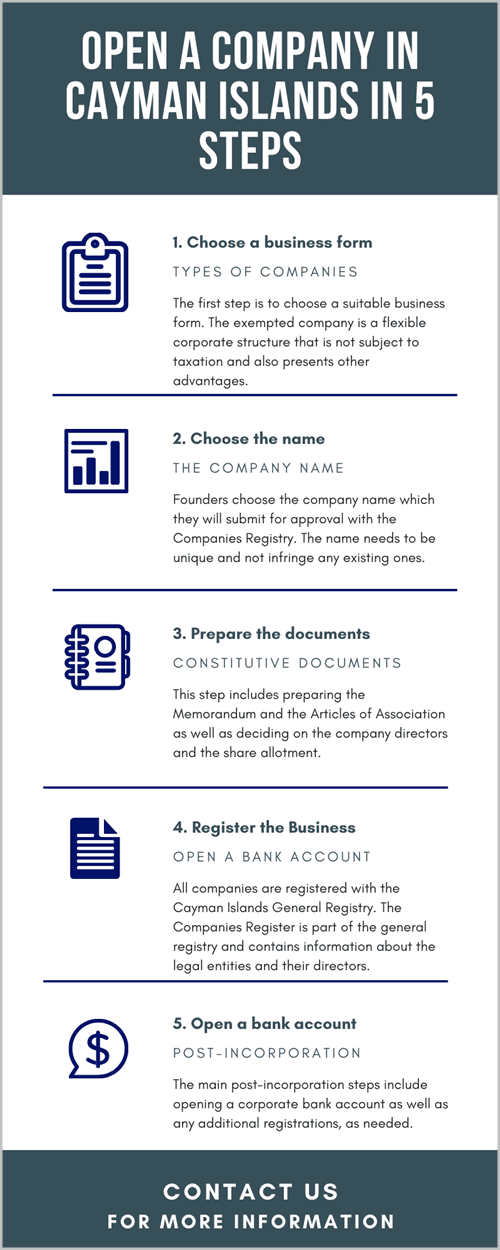

Cayman Islands exempted company incorporation steps

A number of steps are mandatory for the incorporation of the Cayman Islands exempted company. Below, our team of agents who are specialized in opening companies in Cayman Islands lists the most important ones. For more information on each of these points, as well as personalized assistance during incorporation, please do not hesitate to reach out to us.

- Company name: the exempted company is not required to include any abbreviations or words after its chosen name; it can be in English, however, it needs to be unique. This is why our team recommends that investors propose at least two name variants;

- The capital: although there are no requirements, in practice investors will observe the amount indicated by the Government that will allow them to pay the lowest annual government fee (please find below details about this tax);

- The objects: the Cayman Islands exempted company does not carry out activities in the Cayman Islands, although it is incorporated here; as previously stated, it engages in activities outside the jurisdiction, however, it can perform part of those in the Cayman for the purpose of the advancement of its offshore activities;

- Others: another important requirement for the company is to have a registered office in the Cayman Islands.

These requirements need to be observed when opening an offshore company in this jurisdiction. Our team offers complete company incorporation packages. Moreover, foreign investors benefit from a fast-track incorporation, in most cases this being possible within one or two days after the receipt of the required documents.

Exempted company fees

A Cayman Island exempt company is required to pay a registration fee and an annual fee depending on its subscribed capital. Below, our team lists the capital values and the fees imposed by the Companies Register.

Please keep in mind that these fees can be subject to change. If you wish to register a company in 2023, our team will be able to provide you with information on the current fees, if they have been subject to any change, as well as other requirements for opening a company in Cayman Islands.

Registration fee:

- when the capital is up to $42,000, the fee is $675;

- for a capital between $42,001 and $820,000 the fee is $900;

- when the capital is between $820,001 and $1,640,000, the registration fee is $1,884;

- for a capital over $1,640,001, the registration fee is $2,468.

Annual fee:

- when the capital of the company is up to $42,000, the fee is $700;

- for a capital between $42,001 and $820,000, the fee is $1,000;

- when the company’s capital is between $820,001 and $1,640,000, the annual fee is $1,984;

- for a capital between $1,640,001 and $9,999,999,999,999, the fee is $2,568.

Other fees are imposed by the Registry for different types of services. For example, an express service for issuing any type of certificate is usually $100. Penalties apply for failure to notify certain company changes as well as for other late filings. For example, investors in the Cayman Islands can expect to pay a penalty of $10 per day and $500 maximum for failure to file the increase in share capital documents (in addition to the fee for increasing the share capital which is $400 for all types of companies).

Business owners who open a Cayman Islands exempted company will also have to keep in mind other fees, apart from those for registration and the annual fee. These can include the ones for Intellectual Property Registration, for those interested in this step. A trademark registered in the Cayman Islands has a validity period of 10 years and it can be renewed for up to six months after its expiry (with an application for restoration afterward). Examples of registration fees are listed below:

- $200 for one trademark class;

- $65 for each subsequent class;

- $250 for a notice of trademark opposition;

- $200 for trademark renewal, $300 for late renewal and $350 for trademark restoration.

Our team can give you more details about the trademark application process if you need to know more before you register your exempted company.

Buy a shelf company

Shelf companies or ready-made companies are available for those foreign investors who wish to purchase a company that has already been incorporated. There are no restrictions on the nationality of the company founders and shareholder and directors can be either individuals or other corporations. Annual fees for registration will apply, although they are not burdensome for investors.

A requirement for company formation in Cayman Islands is to have a registered office and a registered agent. All the official communications from the relevant agencies will be sent to the company’s registered office located in the Islands. The location of the office is public and any individual can obtain the address after submitting a proper inquiry with the Registrar. Another requirement is that the office is clearly marked with the company’s logo or name. The address of the registered office can be changed by means of a Director’s Resolution and an approval from the Registrar to move the office is issued within 30 days from the date of the Resolution.

While it is not mandatory to appoint an officer, it is advisable to appoint a secretary for the company who will fulfill a set of administrative actions, including but not limited to making sure that the company submits all of the filings in due time.

The registered office and the registered agent services can be included in the special company formation packages offered by companies that provide incorporation services.

The company must submit a set of annual returns to the Registrar, however, the requirements are light and contain the following:

– a statement that there has been no change in the company’s constitutive documents, name, and objectives, other than the ones previously reported (if any).

– the operations of the company have been performed outside the Islands (for the most part and since the last filing).

– the company has not engaged in trading within the Islands, with a company or an individual.

We invite you to watch the following video on company formation in Cayman Islands:

Setting up a Cayman Islands company is a straightforward process and one that can take approximately three or four days, depending on the documentation that is required and whether or not investors provide the needed documents at once.

Businessmen interested in starting an offshore company in other jurisdictions, for example setting up an offshore company in Panama or in Belize, can receive assistance from our partners.

If you need to open a company in Cayman Islands or in another country, such as USA, we can put you in touch with our local partners.

Advantages of setting up a company in the Cayman Islands

Company formation in Cayman Islands has numerous advantages, among which we mention:

- Minimized international taxation: When appropriately structured, a company which is set up here can legally attain international income and minimize international taxation;

- Easy and simple company incorporation: investors need to submit the company’s constitutive documents along with the approved company name, types of shares, authorized capital and registered office address with the Registrar of Companies.

- Light reporting requirements for companies: There are no annual requirements for annual audits or complex accounting procedures. The only requirement is to file an annual return.

- Minimum company management requirements: Cayman Islands company incorporation is possible with only one shareholder and one director. The shareholder and director can be the same individual or a legal entity, and the company can be owned 100% by a foreign citizen;

- Tax-free jurisdiction: There is a complete lack of direct taxation which can be sustained by a 20-year government guarantee against the taxation introduction. To obtain this guarantee, the business owner has to apply for a tax exemption certificate. This implies that there are no corporate taxes, no capital gains taxes, no payroll taxation, no real estate taxes, and no withholding taxes. It is important to note, though, that the tax exemption certificate is only available for exempted businesses;

- Easy management: After the Cayman Islands exempted company registration, the business can be managed from any country outside of the Islands.

The Cayman Islands not only provide a tax-free business environment and very low corporate maintenance requirements, but they also offer a high degree of investor protection. This is possible because there are no mandatory requirements to disclose the identities of the company shareholders and directors.

The Cayman Islands exempted company is a business structure with many advantages for foreign investors looking to open an offshore company that is 100% foreign owned and not liable to taxation.

George Town offers a fast incorporation process, privacy and flexibility to investors who choose to register a company in Cayman Islands.

In addition to opening a company in the Cayman Islands, investors who are interested in registering a trademark can do so at the Cayman Islands Intellectual Property Office.

Frequently asked questions

1. What are the benefits of setting up a Cayman Islands company compared to other countries?

The Cayman Islands is famous for registering offshore companies and it confers an extremely advantageous tax system which does not impose taxes on income, corporate gains, inheritance, capital gains or gifts.

The main difference between the Cayman Islands and other countries, more specifically those that also offer options for convenient offshore company formation, is the use of the offshore business. The Cayman Islands have a well structured company law, a trait that has attracted many foreign investors who were particularly interested in opening businesses of a certain type, for example holding companies. Other differences may also refer to the audit requirements, which may be more stringent in different offshore centers.

2. How much time does it take to incorporate an exempted company in Cayman Islands?

A Cayman Islands exempted company is incorporated when the registration documentation is filed with the Registrar of Companies.

This can take as much as four working days because of the fact that the documents need to be drafted accordingly. Investors who wish to open an exempted company do not need to be in the country at all times, they can outsource the first phase, the one involving preparing the documents, to our team of company formation experts. Therefore, in practice, opening a company in the Cayman Islands will be fast for an interested investor.

The certificate of incorporation is issued by the Registrar of Companies in maximum two to three business days after filing.

3. How many directors must an exempted company have?

Such a legal entity in the Cayman Islands should have at least one director. The company director can be an individual or another company. This requirement is mandatory, however, investors should also know that nominee director services are available upon request. Essentially, this means that the founders do not need to act as company directors. They can add an extra layer of confidentiality if they appoint another individual who will act as director under a fiduciary agreement. The director appointed in such a manner will not be the beneficial owner.

4. Does such a company need to have local directors or shareholders?

It is a frequently asked question we often receive. The answer is no, it is not necessary to have local directors and shareholders for setting up a Cayman Islands exempted company.

5. Is Cayman Islands a tax free country?

The Cayman Islands has an alternative tax system. There are no company or corporation taxes, no income taxation, inheritance, capital gains or gift taxes here.

Investors who wish to register a company in Cayman Islands should note that, although there are no corporate taxes, the business, once incorporated, will be asked to pay an annual fee which is based on the authorized capital.

6. How many shareholders should an exempted company in the Cayman Islands have?

An exempted company in the Cayman Islands should have at least one voting shareholder. Like in the case of the director, only one shareholder is required and he can be an individual or another corporation.

7. What addresses have to be provided for every shareholder or director?

For private persons, a residential address is needed. For legal entities, a registered office address or a business address is required. Another important requirement in terms of addresses for the new company is that it needs to be based in the Islands. The registered office is to be located in the Cayman Islands. Many foreign investors will choose to use a virtual office package when they open a Cayman Islands exempted company. This package is advantageous because the address of the office will be used for registration and, in many cases, the location is a prestigious one, that will add credibility and help maintain a good business image.

8. Do I have to be physically present in the country to set up the legal entity?

It is not mandatory. However, certain documents may need to be signed by the beneficial owner and our team will need a set of documents for the purpose of incorporation. We encourage you to reach out to us in advance in order to find out our express requirements, the documents that are mandatory as well as any other information that may be of interest before starting the actual incorporation process.

9. How much time it takes to close an exempted company in the Cayman Islands?

In general, the time will depend on the size of the business, its activities and whether or not it has due debts to creditors. In practice, in simple cases this can mean approximately three days, however, we strongly encourage you to reach out to our agents to receive more information because a voluntary liquidation is different from a court-ordered one, and the latter is lengthier.

10. How rapidly can I receive the certificate of incorporation?

Our Cayman Islands company formation consultants estimate that the time needed for receiving the certificate of incorporation is around two to three business days, unless it is filed on an express basis, when the certificate is returned in a few hours.

The Cayman Islands are an attractive jurisdiction not only because of tax neutrality and privacy, but also because of the wide range of business fields in which the companies set up here have can be used. This flexibility, as well as the geographical position close to the United States, make it a preferred offshore investment center, especially for US investors. A Cayman Islands exempted company can be used for holding purposes, as well as trading and engaging in shipping operations, for real estate holding (as opposed to companies that are only involved in stock holding – which is also a valid option) to holding the ownership of licenses and patents.

The multiple uses, quick and easy reporting requirements and the accessible obligations in terms of capitalization and management – all make it advantageous to register a company here.

If you have further questions about setting up a Cayman Islands company, please do not hesitate to contact our staff.